In an effort to help moms take a closer look at their finances, we reached out to mothers across the country and asked them to analyze their budgets. Each month, we'll have one mom anonymously tell us her marital status, annual income, and about how much money her family has to work with each month. Whether the spotlight is on a mom who splits the bills with a partner or a single mama making it work on her own, we want to give readers an inside peek into how they're making it work. Then, as an added bonus, a financial advisor (who is also a mother herself) will weigh in with major takeaways and a bit of advice all moms can benefit from.

Going through a divorce isn't easy on anyone, but for a 41-year-old mother with three kids to support, divorce has an extra sting.

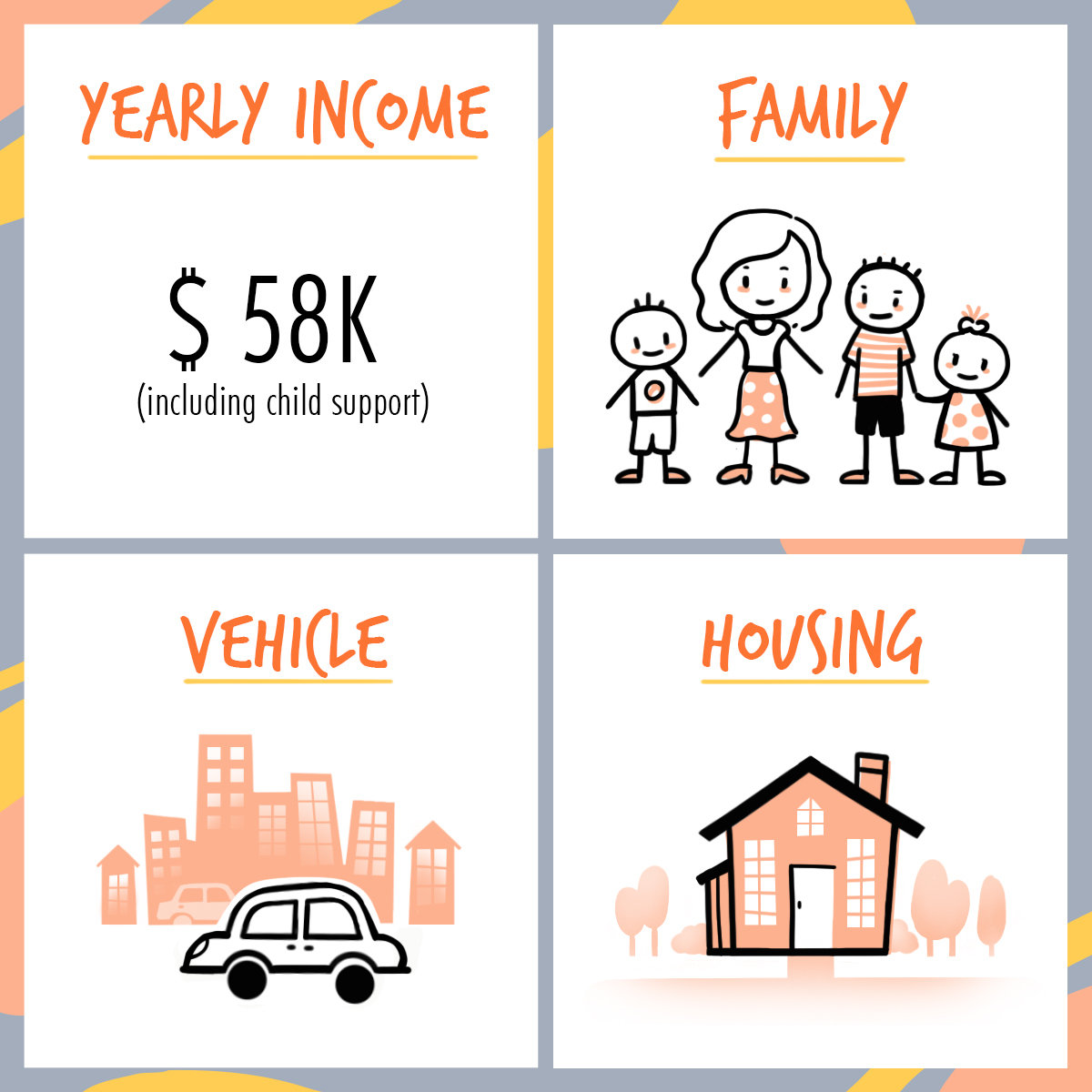

The Nashville, Tennessee, resident has had to hustle pretty hard to care for herself, her 17-year-old and her 12-year-old twins. Though she is technically at $58,000 per year, she is above the average annual salary for Nashville residents, which is $51,754. Divorce has financially ripped through her family, and this hustling mom has to work three jobs. Two of those jobs are smaller side jobs she uses more or less for the discounts, in order to make ends meet.

A lot of times her monthly expenses outweigh her means. Her monthly income nets at $4,500, but her actual monthly spending is $4,865.

Overall, this mom relies on the support of her parents to get by.

"Things don't get paid," she confesses to CafeMom. "Or I make payment arrangements with things like the utilities. I borrow from my mom, and do without things."

This doesn't even include the $179 student loan debt she has to pay monthly — currently it is in deferment. Her expenses are stripped to what she considers the bare minimum — though she does sometimes spend $100 a month on eating out. Her extras really only consist of $40 pet care and the $100 she needs to pay her divorce lawyer. (Luckily, it's a friend who gave her a reasonable rate.)

It certainly doesn't help that her finances are deeply entangled with and impacted by her soon-to-be-ex-husband. Though she and her children do live in the $1,400 a month four-bedroom home and her ex does not, she regularly interacts with his finances. For instance, $20 of her utility bill goes to paying his cell phone. Out of the $794 she pays monthly to credit card debt, she says that $552 of it goes toward paying "his" debts he amassed during their marriage.

She admitted, though, that it was the deal she "signed up for."

"I agreed to accept all the debt in exchange for getting the house (which I plan to sell and will be more than enough to pay off the debt and have money left over) and keeping 100% of my retirement," she said.

She claims, though, that her ex really isn't all that reliable when it comes to support payments.

In total, she says she has received $461 — not nearly what was agreed upon for him to pay. According to her, he is supposed to be giving her his share of the car insurance and phone bill, in addition to $20 per month toward pet care and half of the kids' medical bills. This is all in addition to the mandated $710 per month in child support.

In total, in two months she says she has received $461.23 — not anywhere near the full amount of mandated support, let alone what the agreement designated.

She worries that it means she'll never get back to saving and will fall into foreclosure.

The good news is that our mom is on the right track, according to Nicole Middendorf, a certified divorce financial analyst and a divorced mom herself.

In fact, when looking at all of her financial information, one of Middendorf's takeaways is overtly positive.

"She shouldn’t worry. If she sets up a plan and takes a step every day to get there, she will make it happen. She felt strong enough to take all the debt in the divorce, so she knows she can pay it. So long as she is making her mortgage payments, she doesn't need to worry about foreclosure."

But there are a few things she does need to take care of first.

For one, Middendorf thinks it is imperative that she get rid of her debt.

"She needs to be empowered to get the debt gone, and that should be her complete focus. Especially the money in collections [which she should call and settle first]."

To accomplish this, Middendorf suggests taking a side job that isn't based on discounts (as one can be tempted to spend on things that aren't needed), and enlisting the help of her 12-year-old twins to do a garage sale. Middendorf also suggested cutting out eating out entirely, and because the kids are older, do weekly cook-off challenges to inspire them to help. Of course, she should apply that extra $100 to pay down her debts.

Another corner to cut is to get rid of the home warranty and take that and pay almost $100 a month toward her debt. Even renting out the 17-year-old's room when the teen leaves the nest may be an extra income option. Middendorf also thinks it could be worth it to call collections and see if she can negotiate a smaller fee. It never hurts to ask, she says, because the worst thing that could happen is they say no.

There's also another major thing Middendorf says she really needs to do:

"She needs to have the child support automatically withheld from the county from him so she gets that money, and she needs to use it to meet her budget."

All it takes legally is going to the courthouse and filling out a few papers. County officials will coordinate with him to ensure the money is directly taken out of his source of income.

Oh, and taking him off the cell plan is a good way to start cutting the ties to her ex too.

Though this mom is in the midst of financial and emotional turmoil, Middendorf insists that she (and other divorcing mothers) should know that it'll all be OK in the end.

"She just needs to have some short-term pain for some long-term gain."