In an effort to help moms take a closer look at their finances, we reached out to mothers across the country and asked them to analyze their budgets. Each month, we'll have one mom anonymously tell us her marital status, annual income, and about how much money her family has to work with each month. Whether the spotlight is on a mom who splits the bills with a partner or a single mama making it work on her own, we want to give readers an inside peek into how they're making it work. Then, as an added bonus, a financial advisor (who is also a mother herself) will weigh in with major takeaways and a bit of advice all moms can benefit from.

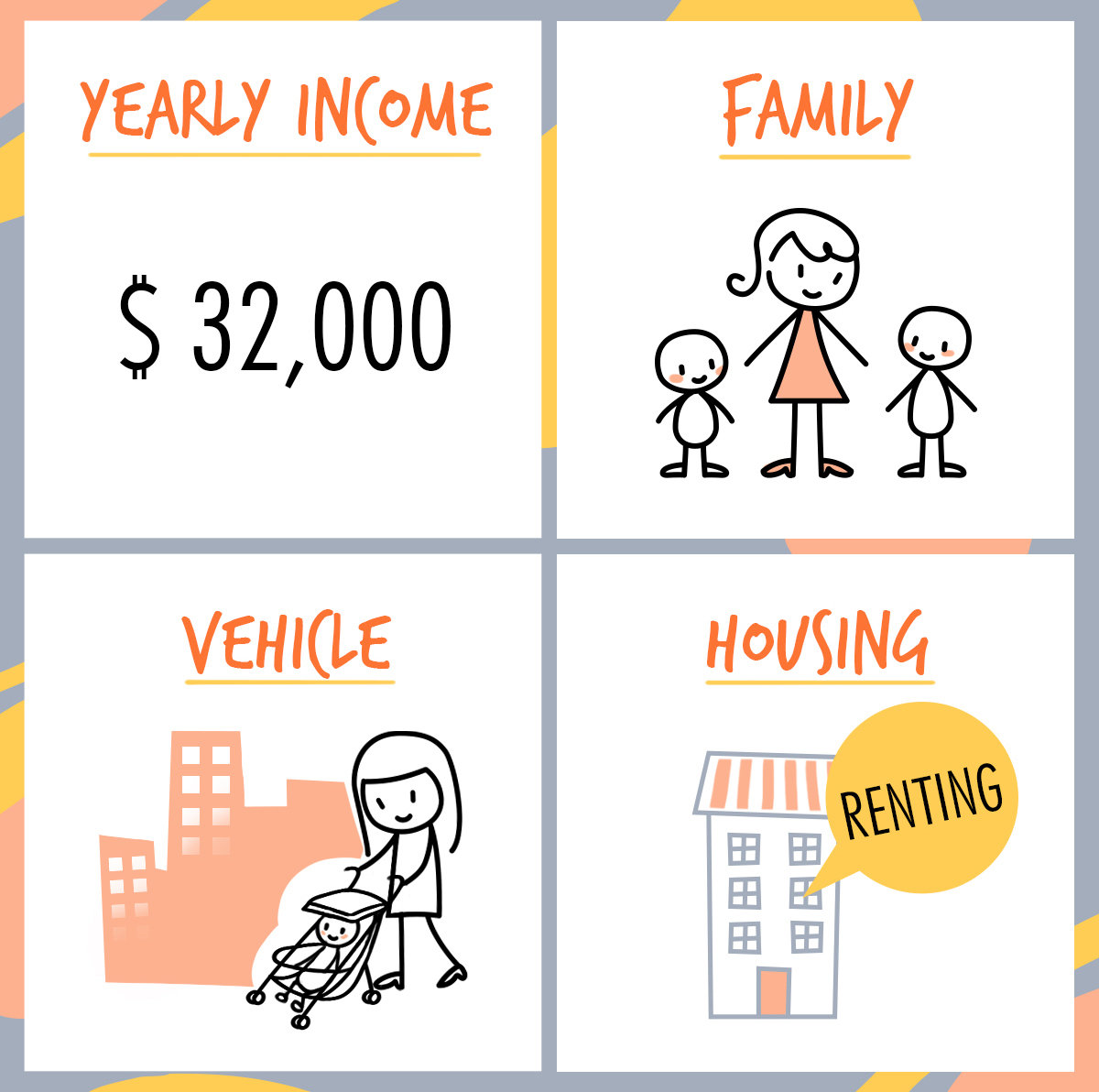

This month, a single, 41-year-old Latina mom of two shared with us how she's making it work in New York City with her family while growing a business.

Currently, this month's mama is attempting to grow her business and keep things afloat for her 17-year-old and 4-year-old sons on $32,000 a year. Her largest expense, which is unsurprising for New York, is the apartment she rents in the city for roughly $751 a month (including gas and water).

"I've had to cut all spending to the bare bones," she explains to CafeMom. "The good thing about working for myself is that I work from home and don't have to worry about transportation ($121 Metrocard) or eating lunch out. We used to eat out at least twice a week. Now it's twice a month — if that — and only things that I can't make at home. I use coupons for everything and am a member of points clubs at my local supermarket (which allows me to get items for free using my points), as well as Duane Reade, Rite Aid, and CVS. I also save money by not keeping my credit card in my wallet and using the 24-hour rule to make any big purchases. Sometimes, I take 48 hours or more to decide. It has served me well."

This mama also makes use of resources around her. She enrolled her family in a health care program called Marketplace to eliminate out-of-pocket costs, and she sends her littlest guy to a universal pre-K.

Other monthly expenses she absolutely cannot cut are utilities, which include electric, gas, and cellphones ($264); and her eldest son's tuition ($560).

The thing she worries about the most is her accrued debt.

Overall, this New York mama is about $10,800 in credit card debt — meaning she pays $250 per month in payments. This isn't even accounting for the $345 she pays toward her student loans. Currently, she can only put $25 per month in savings.

"My biggest financial fear is not being able to make a decent profit from my business that I can support myself and my boys," she confessed. "I wish I could change my credit card debt. In 2012, I was out of work for four months, and rather than take money out of my 401(k) then, I racked up $7K in debt. I see now that even though there is a tax penalty for withdrawing funds early from my 401(k), it would have been much cheaper to do that than use my credit card. An expensive lesson learned."

Financial planner Nicole Middendorf can relate as a single mother herself, and has a few interesting strategies for this New York City family.

Typically, we tend to think that putting savings away, even a little bit, is the best thing we can do. But Middendorf actually wants this mom to focus on one thing: paying down the debt.

"She’s putting money into savings, so she could consider paying down some of the debt. That should be her focus. If you have a credit card charging you 17 percent interest, you cannot get ahead. If you have money in savings earning less than 1 percent, then you should take that and pay down the debt. Once the debt is gone, then you can ramp up savings."

Since this mom is renting, she doesn't have the option of refinancing her home to gain some cash flow back. So Middendorf has a few major suggestions:

SPEND TAX REFUNDS WISELY

"If she is getting a refund on her tax return, she should use it to pay off the credit card debt and then change her withholding. Getting a tax refund is not a good thing. You are giving your money to the government each month, and they are not paying you interest."

NEGOTIATE

"Call the credit card company and see if they will lower the interest rate. What is the worst thing that can happen? They will say 'no.' Also, if she can consolidate her student loans, she should."

PUT THE 401(k) TO GOOD USE

"If she's currently self-employed, it’s her previously mentioned 401(k) is old. She may want to look at rolling that over into an IRA. In an IRA there are more investment options and more flexibility. But with the IRA there is no loan option where there possibly could be on the 401(k). So how much is in there? A loan on your 401(k) is the last resort, and she is correct in thinking that and doing that. I would want to look at her 401(k) plan and how it is invested. Not cashing that out was a smart thing. Once the tuition expense stops, she can put that back toward savings."

Middendorf also added that getting a job while waiting for her business to take off, if it's possible, would be a good strategy, too.

Her biggest piece of advice?

"Credit card debt is so much better off managed by cutting expenses, increasing income, or giving up things for a short period of time. Even taking the credit cards and putting them in a glass of water and in the freezer is helpful. This way, they have to thaw out before you can use them, and usually by the time they thaw out you're not 'needing' whatever you had to have at that time."

She also shared a little empathy that any single mom can take some comfort from.

"Being a single mom and raising two kids by yourself is tough. The one thing that can save you money as well as teach your kids about money is to give them an allowance. So rather than paying for her cell phone and her child's, she can give her 17-year-old an allowance. Generally, if kids have to pay for something with their own money, they are less likely to 'have to have' that item. Or they are more careful where they spend their money."

And that's how she does it, on a budget!

Learn how a family on a $160K budget does it here.