As the holiday dust settles and the family adjusts to its routines once more, it feels like things are back on track to start the new year off right. But around this time is when moms get "blindsided" by the holidays for the final time. It's just about when she gets the credit card bills from the holiday shopping bonanza.

Getting caught off guard is understandable in some ways. By the end of the holiday rush, you're throwing gifts in to real and virtual carts with a wild abandon, along with all of the food and booze needed to make your holiday celebrations merrier. Or yanna, at least tolerable. Most of us tend to give and spend more than we meant too, so those mid-January bills can come as a bit of a shock.

But with a new year comes a new chance to set our spending budgets right. But starting such a process can be incredibly overwhelming. To help moms hit the reset button, we got in touch with several financial experts, who happen to have families of their own, to get the best money management tips for getting households back on track after an expensive holiday season.

The tips we gathered require families to take a good, hard look at multiple budget facets. Experts want moms to not only restrict spending, they want them to look at "hidden" charges like useless subscriptions, make small adjustments by making a shopping list, and look into their communities for free things to take into consideration. Moms should definitely check out these helpful tips to start saving today.

Go on a spending diet.

__"__A 30-day no-spend challenge is a great way to detox your budget and bounce back quickly from overspending. For one month, don't buy anything that isn't an absolute necessity. Remember, needs include mortgage or rent, groceries, utilities, auto loan and insurance or transportation costs, and any health care expenses. Wants, like going to the movies, dining out, clothing purchases, beauty services, and so on, should be placed on hold for the month."

— Andrea Woroch, nationally-recognized consumer and money-saving expert

Establish a junk food (or treat) day.

Establish a treat day for your kids! Nowadays, a trip for fast food can get costly, but occasionally we all need a break and want to be lazy about meals. Find an option that is junky enough for your kids and is healthy enough based on your values, then schedule that activity every week or every other week. For example, a slice of pizza per kid at $5 every Friday can help you avoid an unplanned XXL-pizza $40 order for the entire family every weekend. Both you and your kids will look forward to the junk food day. It's a win-win-win: fun for kids, a chance to relax for the mom, and a great way to save over time.

— Anna Belov, investor and financial wellness coach, author of Just Over Broke? (2019)

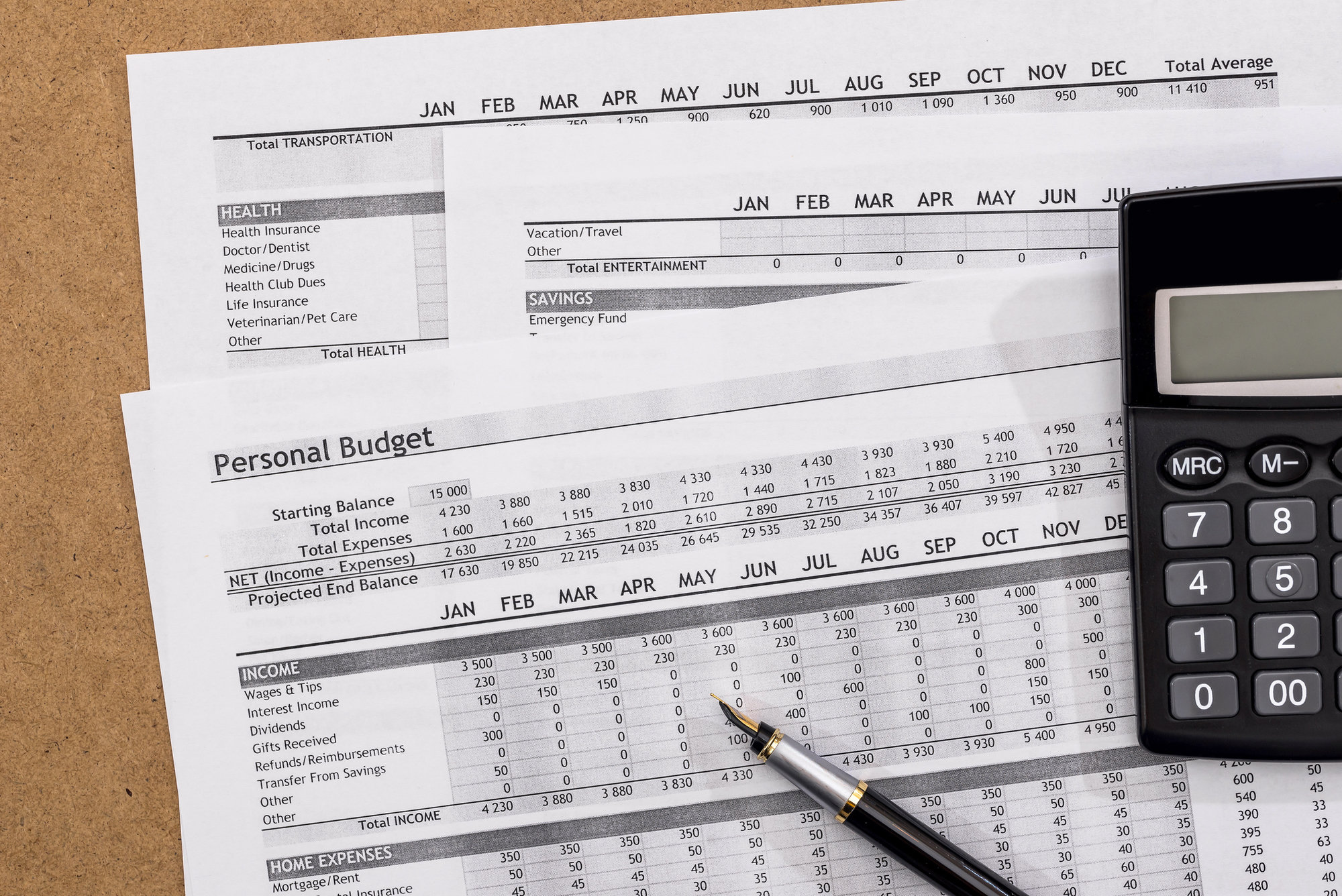

Review and update household budgets.

"By reviewing your budget in the new year, you may find areas where you could be wasting money and then reduce your expenditures. Maybe there are opportunities for you to buy supplies in bulk and cut costs. Perhaps your bank is charging you with unnecessary or hidden fees. You’d be surprised where you can find some ways to cut down on your budget."

— Gisele Goes, Content Marketing Manager, Growth for Chime.

Assess subscription services.

"The beginning of the year is also a great time to reassess subscription services. Think about how often you used each subscription the last few months. If you used it more often than you liked (e.g. Netflix), would canceling it help you and your family do something more worthwhile? The added bonus is that you’ll save money, too."

— Steffa Mantilla, Budgeting & Debt Payoff Specialist, Plantsonify

Invest in apps.

"I been using money saving apps like GetUpside, Ibotta, and Receipt Hog to save money after overspending during the holidays. With these apps, I get cash back on my grocery store and gas purchases!"

— Becky Beach, Money Saving Expert and Finance Blogger

Go shopping.

"Take a look at your ongoing expenses — phone, cable, subscriptions, insurance, etc. — and shop for deals with your current providers and their competitors. In many cases, you will find a better option at a comparable or lower price. You will also come across some expenses, features, and services you no longer need and can cut to save without sacrificing anything valuable. Since your bills are recurring, your savings will multiply automatically.. For example, $10 saved on car insurance every month will lead to 12 x $10 = $120 saved in a year."

— Anna Belov, investor and financial wellness coach, author of Just Over Broke? (2019)

Manage utilities.

"Utilities are another area where a household can recognize big savings. Things like unplugging unused appliances, hand washing dishes, and washing clothes in cold water will drastically cut your utility bills."

— Shawn Jones, owner of HealthyWealthySkinny.com

Mind the taxes!

"Taxes are one of the most significant expenses we pay in our lifetime. An excellent proven way to save is to get tax savvy and pay less tax legally, especially for solopreneur-moms! First, go through the top 10 most commonly overlooked deductions, either on your own or with your accountant. Next, use your last year's tax return as a case study to learn about taxes and how you can save in the future. Lastly, draft your upcoming tax return before your account does it for you. Going through these steps will help you know enough to ask the right questions during the tax season, so your accountant can help you maximize your savings."

— Anna Belov, investor and financial wellness coach, author of Just Over Broke? (2019)

Focus on being healthy.

"Get adequate amounts of sleep, drink sufficient (more) water, eat healthily, quit smoking, take probiotics, be active, enjoy friends and family. By focusing on living a healthy lifestyle, you will get sick less often. If you are sick less, and feeling great, you are more likely to make wise money decisions."

— Christina Lynn, Certified Financial Planner

Track spending.

"Tracking each and every dollar you spend holds you accountable to your shopping habits and helps you make better buying decisions. You can achieve this by writing down each purchase and the dollar amount spent on a piece of paper or just use a tracking app, like Mint, to see your spending in real time. Quickly, you will realize how much money you’re wasting and can make goals to boost savings by cutting out these impulse buys."__

— Andrea Woroch, nationally-recognized consumer and money-saving expert__

Create a DIY nail spa.

"How much do you spend getting your nails done each month? $50? $100? While professionally done nails do indeed look amazing, this is something you can temporarily do yourself at home to save some money. As a financial professional, I am surprised to see how many women spend money to get their nails professionally done that cannot afford it."

— Christina Lynn, Certified Financial Planner

Pay with cash.

"People paying with cash spend 20 percent less without feeling deprived, according to research by the National Foundation for Credit Counseling. It’s better than using a check or debit card. Even the sight of a credit card logo on most debit cards excites consumers, studies show. So leave those cards at home under lock and key."

— Pamela Yellen, founder of Bank On Yourself, a financial investigator, and the author of The Bank On Yourself Revolution: Fire Your Banker, Bypass Wall Street, and Take Control of Your Own Financial Future.

Enjoy time with pets.

"Rover.com can connect you with good paying dog-sitting and dog-walking opportunities in your area. (Mom) Sitters are able to work right from home, choose their own rates and have the flexibility of scheduling their work around their availability. Rover sitters/walkers can easily earn over $1,000 per month, which goes a long way when trying to save money."

— Andrea Woroch, nationally-recognized consumer and money-saving expert

Remember the goal.

"This helps you to decide whether or not what you are about to purchase is more important than your goal, and realize that every time you don’t spend money, you’re closer to reaching your goals. You’ll make spending decisions today that not only build happiness for you now, but also ensure a happy future."

— Pamela Yellen, founder of Bank On Yourself, a financial investigator, and the author of The Bank On Yourself Revolution: Fire Your Banker, Bypass Wall Street, and Take Control of Your Own Financial Future.

Save first.

"Structure your finances around your savings rate (the percent of your income that you want to save). Start by looking at your current monthly spending, and four weeks’ income. Only base your monthly budget on four weeks’ income, because that’s all you can expect to earn in most months. When you get an occasional bonus paycheck, just put it straight toward savings. List your savings rate as your first expense. Then fill in other expenses in your budget, and cut whatever you have to in order to make your savings rate work.

Next, automate the actual savings, so it’s the first 'expense' paid each time you get paid. Set up automated recurring transfers to take place on the day you get paid, for every single pay cycle. Better yet, have your employer split your paycheck’s direct deposit, with your savings going directly into your savings account.

The easiest way to not spend money is to simply remove easy access to it."

— Deni Supplee, co-founder at SparkRental.com

Declutter and sell unused items.

"Most moms are probably feeling pretty overwhelmed by all the toys around the house after the holiday haul. Make extra money and declutter your home by selling unused items at consignment shops, or an online marketplace."

— Shannon Caims, a family finance and frugal living expert at thefrugalfootdoc.com

Ask why, and ask often.

"As yourself why you want to buy something — whether it’s for yourself or as a gift. You may realize that you’re being manipulated into it by advertisements. Just that awareness is often enough to quench the thirst. Another surprising tip: Clench for savings! Making a fist or flexing your biceps has been shown to help people resist at the moment they’re standing in front of a tempting purchase."

— Pamela Yellen, founder of Bank On Yourself, a financial investigator, and the author of The Bank On Yourself Revolution: Fire Your Banker, Bypass Wall Street, and Take Control of Your Own Financial Future.

Look for freebies.

"A new year means a fresh calendar of birthdays, so spend time finding out if your family’s favorite brands and restaurants offer birthday freebies. For example, Olive Garden offers a free appetizer or dessert on your birthday. Best Buy also offers their members a birthday gift to be claimed during their special month. Free birthday treats are perfect for helping you to cover the costs of birthday celebrations. Sign up to your family or friend's favorite brands with their birthday to receive the freebies at the ideal time."

— Alice Gerwat, money-saving expert for Magic Freebies

Make a list.

"Check your pantry and list down the food items in there. Before doing grocery shopping, make sure to check your pantry first as you may have leftover grocery stuff that you can cook in the next couple of days."

— Pratibha Vuppuluri, Chief Blogger, She Started It!