Money is a universal certainty in life. It's needed to survive, yet a lot of people don't understand how to manage it — and that's totally normal. Money is an object, but it's also emotional. How we understand money is a mix between how we grew up, our personal interests and our income level. That's where we come in. As someone who learned how to pay off debt and save early, I can tell you it's easier than you think. And these money management apps make it even easier.

Below are apps that are geared toward different money goals. Want to stick to a budget and meet savings fund goals? There are apps for that. A place to park money and have someone else invest it? There's an app for that. Having an app to manage joint accounts and bills as a couple — or invest in a 529 College Savings Plan? Apps for that, too. Take a peak and pick the one that'll help kickstart finances in an easy and fun way.

Acorns

Acorns is an app that's great for people who are looking to save or invest their money without thinking too hard about it. It's also great for people who want the saving to be automated.

How it works: Once you get an account (and there are different kinds of plans and affordable price points) the main thing Acorns does is round up your spending to the nearest dollar or more and stashes that in savings — or invests it, if that's where you want it to go.

Mint

Mint is a money management app that's great for people who like to have their account information all in one place as well as their money-in and money-out spending and savings tracked.

How it works: Sync up all of your accounts and Mint makes them all accessible within the app. It also has a budget that knows where to add the money you spend and shows you if you're spending too much in a certain area. It also can show your bill or loan amount due to track that number go down as you pay it off.

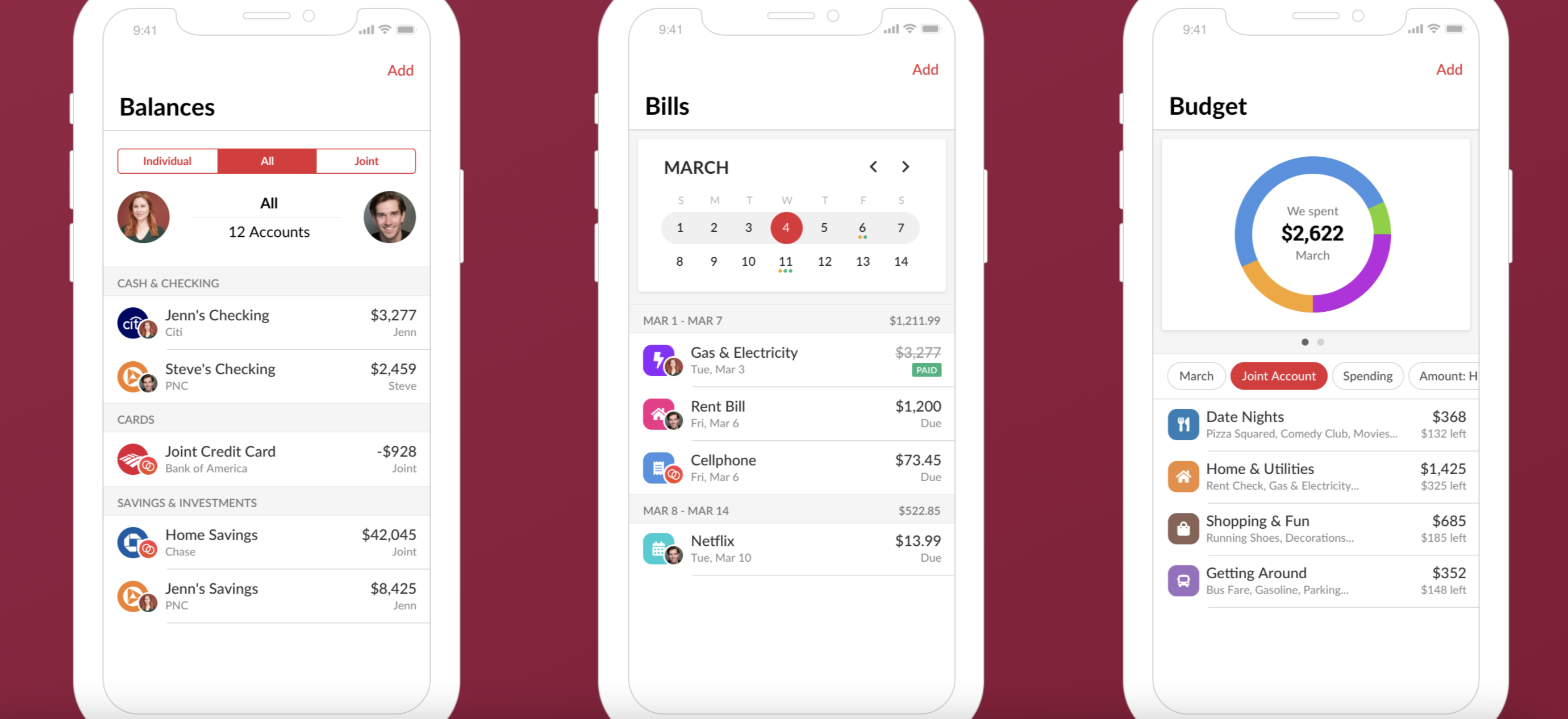

Honeydue

Honeydue is a money management app for couples, or people who share common bills and finances.

How it works: Sync up each person's accounts, individual or shared, and Honeydue makes it easy to see every account all in one place. Users can also add bills as well as loans or other payments to be made to the joint budget so it's all in one place for both parties to see and to help the couple stay on budget.

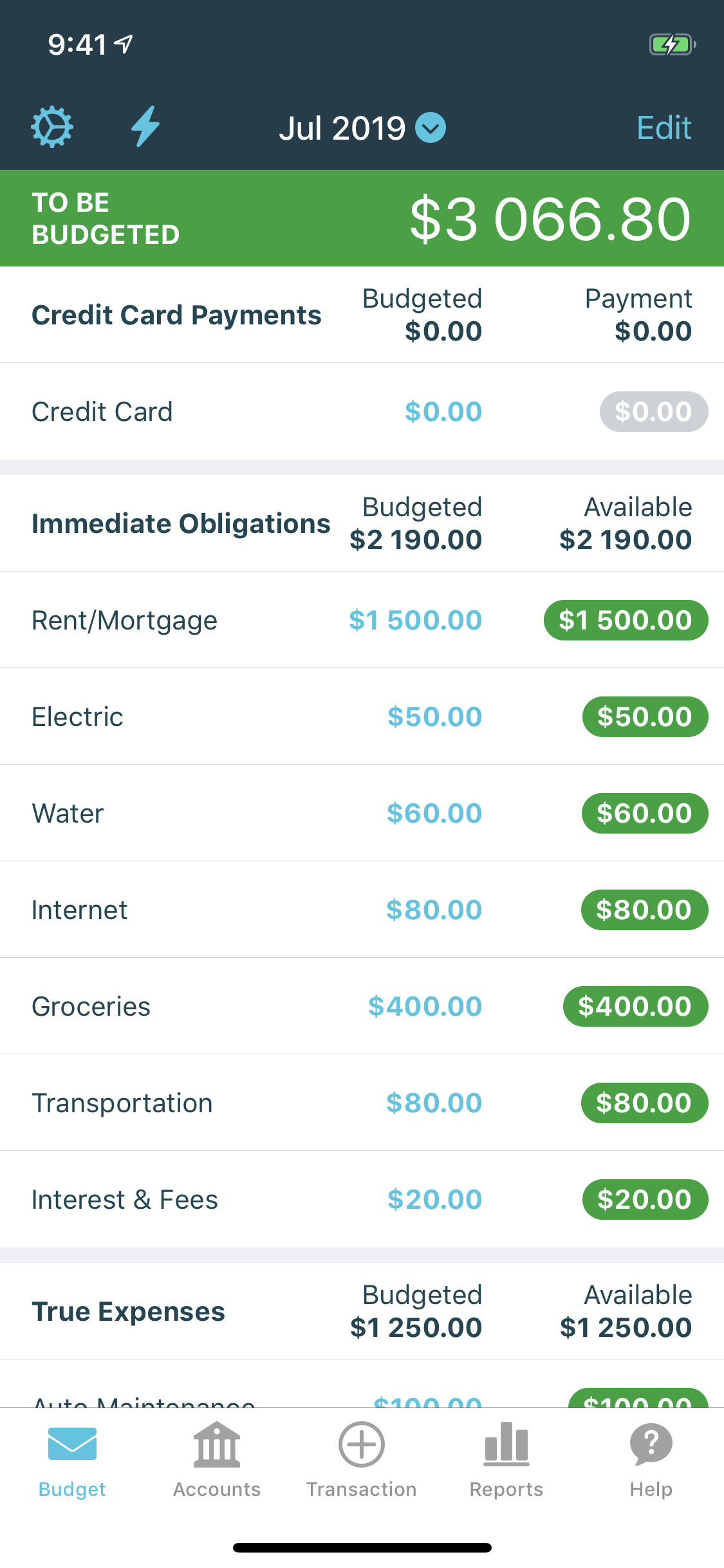

YNAB (You Need a Budget)

It's obvious in the name but YNAB (You Need a Budget) is an app for people who want to have a budget and know exactly where every one of their coins is going — whether it's to bills or a savings account.

How it works: You sync up your bank accounts and create budget categories with spending amounts or savings goals. It allows users to map out where every dollar will go and tracks the money in and money out to stay on track of those goals. The app also has loan calculators to figure out how much to put toward the loan each month to meet payoff goals.

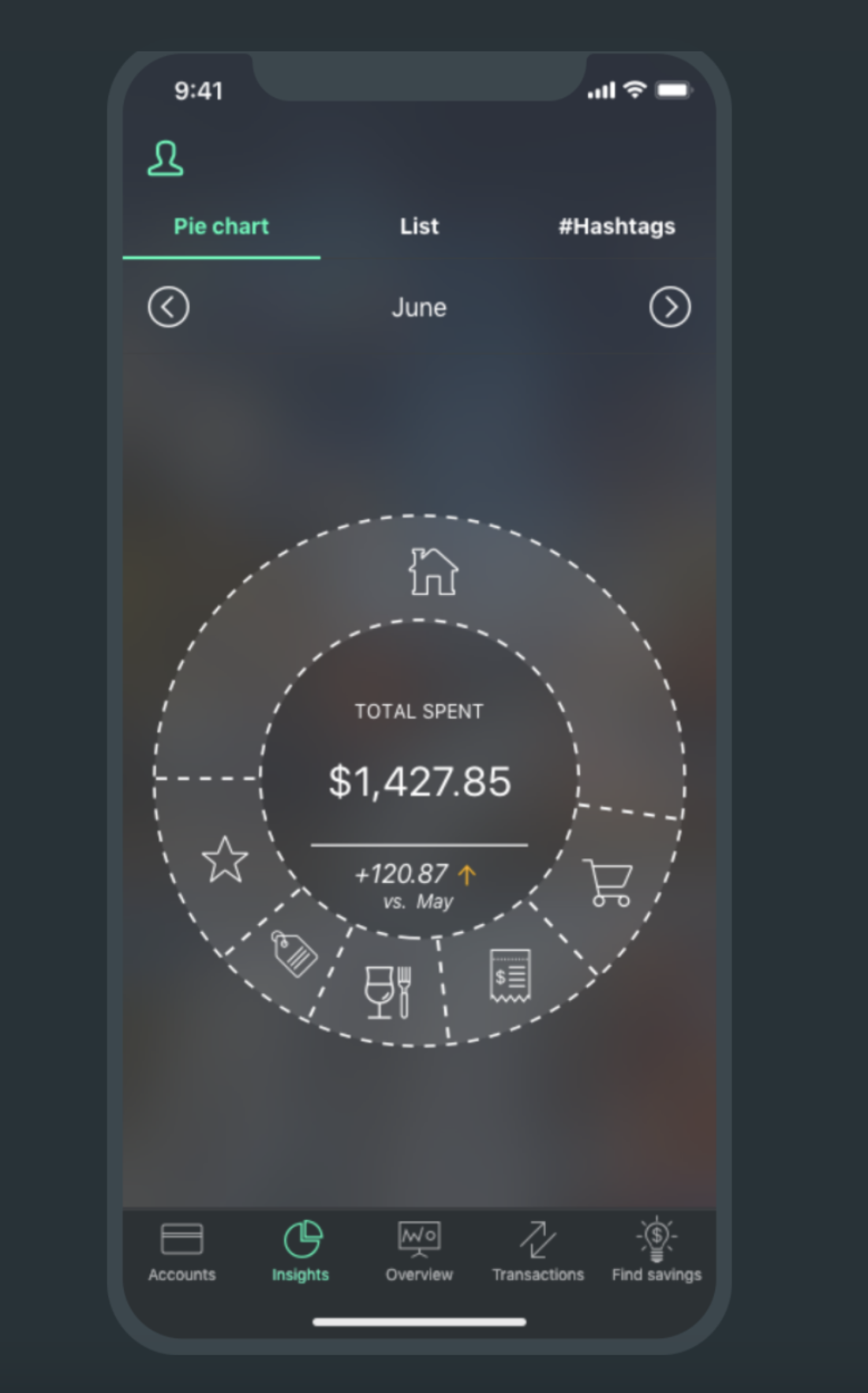

PocketGuard

PocketGuard is an app that helps people manage the money that they have, from bills to debt to savings. It's an app for those who want to create and stick to dollar budget amounts for spending categories as well as those who want sinking funds to save for things, too.

How it works: Set up a budget that indicates how much money is allowed to be spent in individual categories for the app to track in list and graph form. Also create different saving funds to track saving progress. It can list each credit card bill in one place as well as track when they're due.

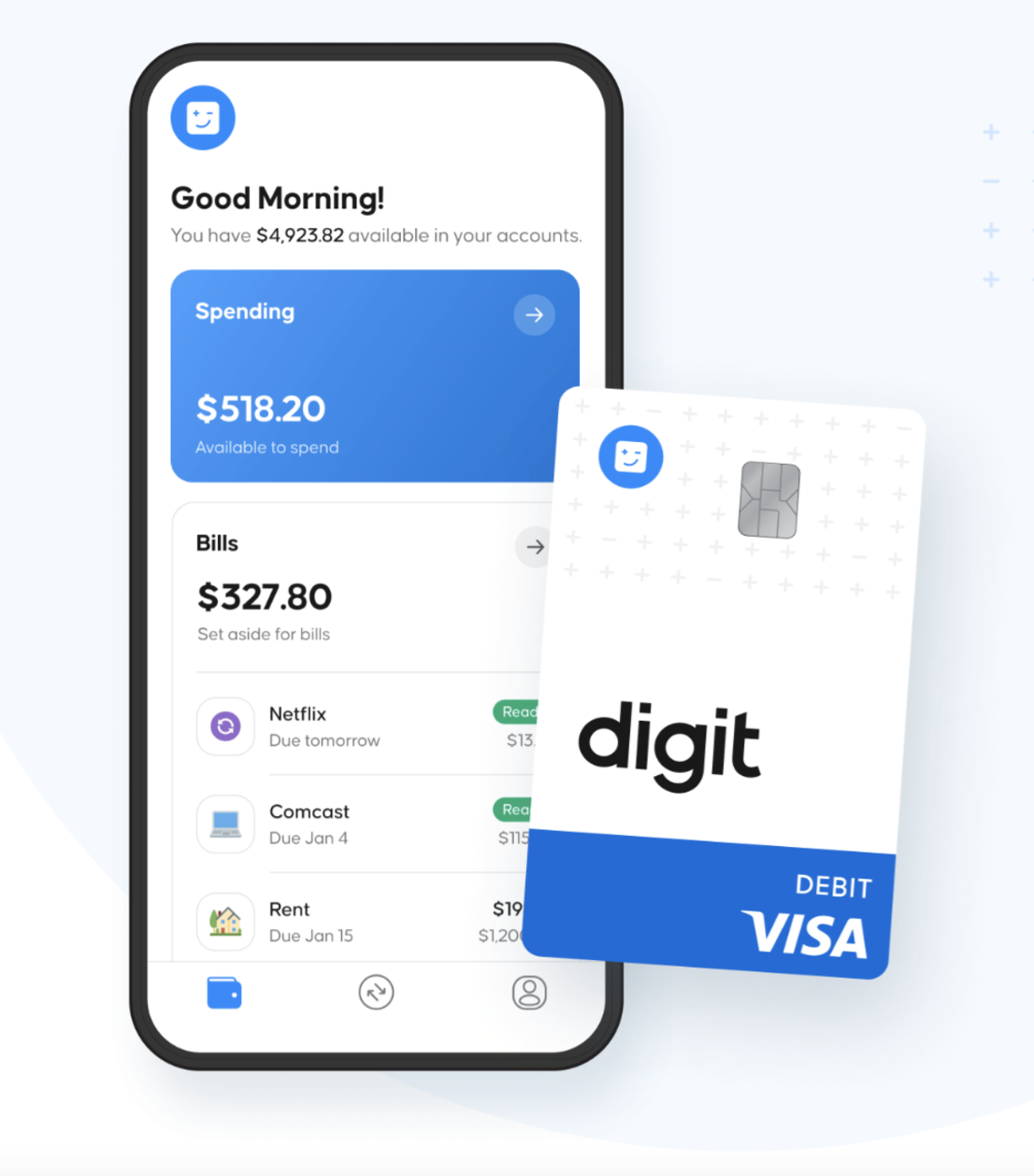

Digit

Digit is another budget, saving, and investment tracking app that helps manage spending and saving. It's great for people who want to make sure they're spending and saving exactly what they want to without having to think too much about it.

How it works, according to Digit: "The first thing you see when you open the app is how much is cool to spend. Digit knows about your expenses and goals, and smartly splits up your deposits for bills, savings, and long-term investments. Digit uses machine learning and financial best practices to calculate how much should be available in Spending at any given time. This is based off your deposits, what you owe, and planning for way down the road."

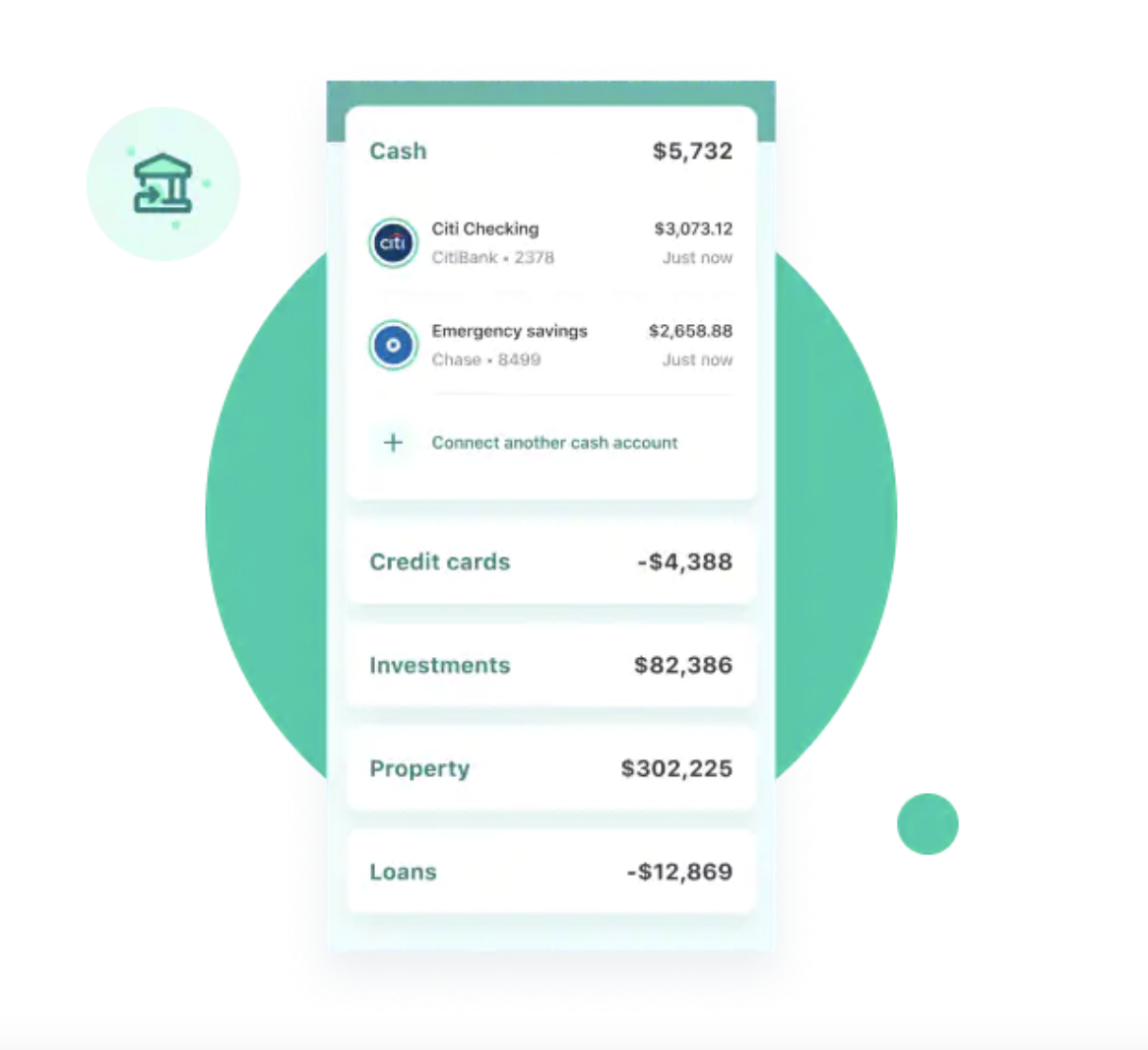

Nerdwallet

It's fitting that Nerdwallet app has wallet in its name because that's the general concept of the app. It is a one-stop shop place for all things finances. It's an app for people who don't only want budgeting assistance, but to see cash they have coming in, their credit score, or overall net worth.

How it works: Download the app and set up the categories you'd like to see. It's free.

Chime

Chime is an tech company that does what banks do in terms of money management, but online only, and with features that include rounding up purchases to add to savings accounts as well as offering a no-overdraft fee promise called "Spot Me" that allows users to overdraft their account to hold them over until the next payment if they added $200 in the last month to the account. It also comes with a debit card. It's great for people who want to do their banking online, need a little room before paychecks, but also have that bank passively do a little more for saving.

How it works: Link up other banks or add money or a paycheck's direct deposit to the app and manage your money within.

Betterment

Betterment is a wealth management platform that is for people interested in investing and having as much or as little involvement in it as they'd like. It allows users to set up savings portfolios for short-term savings goals that is invested as well as Roth and retirement savings accounts.

How it works: Open accounts that will help you set investment goals and synch up a bank account to easily transfer money into those accounts (automatically or manually). Betterment will automate investments based on the level you want.

Stash

Stash is an app for people who want an easy way to invest their money with expert guidance at an affordable price.

How it works: Choose a plan for either $1 or $3 a month and get investing access with a personal portfolio, advice for beginners, and banking and insurance capabilities.

Backer

Backer is an app for parents who want an easy way to put money away for their kids' college education. It not only helps parents keep the money in one place (accountability!) but also invests the money tax-free. The best part is that multiple people can contribute to the fund with a Backer link. It takes a village, after all.

How it works: According to Backer, it starts with creating an "FDIC-insured account for free and upgrade to investing your savings tax-free with a 529 plan."

Bank Apps With High-Yield Savings Accounts

A high-yield savings account is an account for people looking to grow their money passively but not invest it.

How it works: It's an account that earns you interest based on a set rate set by that bank. For example, many non-high yield savings accounts associated with banks have interest rates less than 0.2%, but some banks have much higher rates to offer. Capital One for example has a 0.40% APY, which means each month, 0.40% of the total amount of money in the account is added to the total. Some banks just require no more than six withdrawals. Just make sure the bank you use has an app to easily access the account.